Workers Comp Insurance - Save Up To 30%

Any Risk Class | Min. $50K Annual Workers Comp Premium

“We’re creating a Paradigm Shift. Our platform is disrupting an antiquated, broken, and fragmented industry.

The 360 Preventative Health Plan + Workers Comp Risk Mitigation Platform put employers in a powerful position.

Employers now have a pathway not only to providing employees a "$0 additional net cost" comprehensive "add-on" benefits package, but a platform that permanently reduces workers comp premiums and claims by up to 30%.

It’s going to take business owners coming together with a shared vision to create a permanent impact. We're calling on you, the business owner, to join us in our collective effort to add these spiraling costs back to our balance sheets. We're doing our part!”

- CEO: Mathew Yates

SIG - Self Insured Group

A SIG operates like a vigilant partner, ensuring that only legitimate claims are paid. Every claim is thoroughly investigated, which helps control costs and maintain efficiency in claims management. With our SIG, your best interests come first. To this day, our SIG has successfully kept premiums steady without any increases. Keep more of your working capital.

Technical Definition of a SIG:

In Workers' Compensation, a SIG stands for Self-Insured Group. A Self-Insured Group is a collection of employers

who pool their resources to self-insure their workers' compensation liabilities.

Key Differences You Need To Know

You shop your Insurer every year, but when was the last time you shopped your broker?

Would you believe it if we told you, they're both motivated to raise your premiums?

TYPICAL WORKERS COMP INSURER

❌ Claims receive very little resistance or due diligence.

Why? For every claim paid, THEY RAISE YOUR PREMIUMS.

❌ Sets your business up for failure by design: If an insurer continues to find every way possible to raise premiums, that motivates brokers to place business with them, considering brokers are compensated based on premiums, and receive renewal compensation from that business.

❌ Unregulated Insurance Company Profits: The biggest reason for rising premiums is the unregulated increase in the premium charges' insurance companies add on to workers’ medical treatment and weekly benefits. This is called the “loss-cost modifier.”

❌ The Endless Spiral: While squeezing business for higher and higher premiums, insurance companies have added an additional $200 million to the cost of workers’ compensation. Insurance companies choose the injured worker’s doctor and dictate the medical treatment. They currently pocket 83 cents in profit for every dollar spent, thanks to the loss-cost modifier.

SELF INSURED GROUP

- Risk Management That Saves You Money -

At Employer Cost Savings Group, our goal is to create healthier employees while saving you money. This is why we've partnered with a Self-Insured Group (SIG) for Workers’ Compensation, to help businesses significantly reduce their workers’ comp expenses.

By leveraging a Self-Insured Group, you gain the advantages of self-insurance without the financial burden of carrying the risk yourself.

Our partnership with the SIG not only delivers up to 30% savings for your worker’s comp premiums, but also includes a robust risk management resource: our signature 360 Preventative Health Plan.

This plan is packaged with...

✅ A Benefit Credit

✅ Universal Life Insurance policy for your employees.

The best part is that the benefits are paid for with...

✅ FICA tax savings - creating a win for you and your employees.

- Here's Why Employers Partner With Employer Cost Savings Group & Our SIG -

✅ Fights to thoroughly investigate & DENY faulty claims.

✅ Demotivates Workers Comp Brokers (15% - 20%+ Commissions), because they do not keep raising premiums in which brokers are compensated, removing more capital from YOUR business.

✅ Risk Pooling: By joining together, these employers create a larger pool of resources, which can help manage the financial risks associated with workers' compensation claims.

✅ Regulation & Approval: SIGs are typically subject to regulation by state workers' compensation agencies. They must meet certain financial and operational criteria to be approved and maintain their status as a self-insured group.

✅ Benefits: SIGs can provide several benefits, including potentially lower costs for workers' compensation insurance compared to traditional insurance policies, improved control over claims management, and the ability to implement tailored safety and loss prevention programs.

✅ Funding: Members of a SIG contribute to a common fund, which is used to pay for workers' compensation claims. The contributions are based on various factors, including the size of the employer, the nature of their business, and their claims history.

✅ Joint Liability: Members of a SIG may share joint liability for claims. If one member faces large claims that exceed their contributions, the other members might be required to cover the shortfall.

✅ Conclusion: Overall, a Self-Insured Group can be an effective way for employers to manage their workers' compensation obligations collectively, potentially reducing costs and improving claims management.

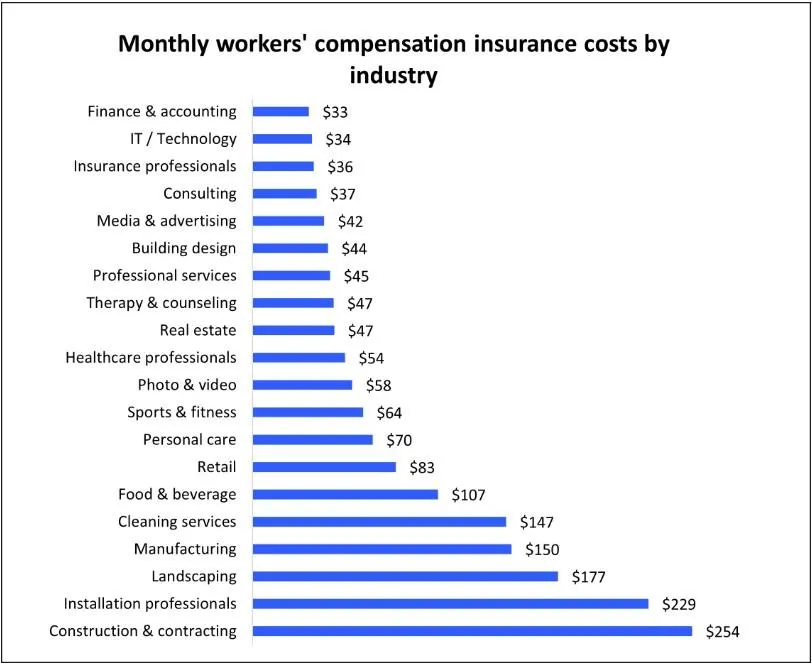

How We Reduce Your Workers Comp Insurance

You Shop Premiums Annually, But Do You Shop Your Broker?

You're Over-Paying.

How We Can Reduce Your Workers Comp Premiums and Claims by Up To 30%:

✅ Significant Reduction in Broker Commission

✅ Access to Wholesale Pricing (SIG)

✅ Risk Classification Analysis (Your Current Insurer May Have Mis-Classified Your Risk to Charge Higher Premiums)

✅ Proper Claims Investigation & Management

✅ Installing Our Comprehensive 360 Preventative Health Plan + Workers Comp Risk Mitigation Platform (Section 125 P.O.P. Approved)

Risk Management That Saves You Money

While these benefits save you money, and mitigate risks, they also make your company a preferred employer of choice within your communities. Longevity.

Along with 360 Preventative Health Plan benefits, employees also receive Universal Life Insurance, which offers:

✅ Guaranteed Issue - meaning there are no medical exams or clauses.

✅ Permanent, portable coverage that stays with them even if they leave the company.

✅ Death benefit protection for their loved ones.

✅ Living benefits that allow them to access up to 75% of their death benefit if they face a critical or chronic illness or injury.

✅ A cash account that grows guaranteed interest, which can be used for loans or as a source of retirement income later in life.

360 Preventative Health Plan Benefits

Employer Benefits

Employer Benefits:

✅ Workers Comp Insurance Premium Discounts

✅ Incentivized "Add-On" Employee Benefits Package at "$0 Additional Net Costs"

✅ Significant Reduction in Employee Turnovers, Absenteeism, Presenteeism + Associated Costs

✅ $500+ Employer FICA Savings

✅ Wholesale Workers Comp Insurance Broker Commission Model

✅ Comprehensive Claims Investigation & Management

✅ No Fees. No Credit Check. No Risk

✅ Correct Risk Class

✅ Fully Insured or Self-Insured Groups Accepted

✅ Comprehensive Marketplace Analysis (Guaranteeing Maximized Premium Savings)

Employee Benefits

Employee Benefits:

Employees will have access to the 360 Preventative Health Plan with...

✅ Up to $150,000 "Cash Value" Life Insurance Policy (Guaranteed Issue)

✅ 24/7 Telemedicine with $0 co-pay

✅ Health Risk Assessment

✅ Wholeistic Coaching

✅ Counseling Services

✅ Prescription Discounts

✅ $200 - $400 In Employee FICA Savings

✅ 4% - 6% Employee Raise (If Chosen by Employer) and more—all without affecting their take-home pay.

The benefits are paid for through tax savings, ensuring employees don’t need to cover any costs of these benefits out-of-pocket.

We guarantee a 15-minute call with us will prove to be worth your time. We'll show you everything, exactly how we can do what we do.

You'll have everything you need to make an educated decision.

Sample Savings Calculation

(Based on 200 employees)

✅ Current Workers’ Comp Premiums: $750,000

✅ Self-Insured Group (SIG)/ALLOY Quote: $680,000

✅ TBS & ALLOY Quote: $650,000

✅ TBS 360 PHP FICA Savings: $117,960

Total Annual Savings: $217,960

✅ 3 YR: $653,880

✅ 5 YR: $1,089,800

Executive Bonus Strategies

The most tax advantaged way to access your savings

Beyond cost savings on workers’ compensation and FICA taxes, we offer executive bonus strategies that allow you to reinvest your newly found savings back into your business in a very tax advantaged way.

By utilizing corporate tax savings, we can help you invest in Key Employees to further benefit both the company and its leadership.

Access balance sheet capital without:

✅ Paying a distribution or dividends tax

✅ Holding capital and paying a retained earnings tax

** Capital remains on balance sheet as an accounts receivable.

COPYRIGHT © 2024 - THE BENEFIT STORE DBA EMPLOYER COST SAVINGS GROUP LLC - ALL RIGHTS RESERVED

NPN #19677564 | CA #6004127 | NV #3593959