EXECUTIVE BONUS PLANS

- Split Dollar & Section 162 -

** CUSTOM-TAILORED ILLUSTRATIONS PROVIDED FREE OF CHARGE

Has your CPA maximized your deductions, and now you're left wondering what to do with your retained earnings? This is the most tax advantaged vehicle for doing the following...

✅ Access balance sheet capital without paying a distribution or dividends tax

✅ Avoid holding capital and paying a retained earnings tax

✅ Capital remains on balance sheet as an accounts receivable

Split Dollar Executive Bonus Plan

(Our 4 Part Framework)

SCROLL TO DISCOVER

SPLIT DOLLAR EXECUTIVE BONUS PLAN BENEFITS

EXECUTIVE BONUS PLANS - KEY EMPLOYEES (SECTION 162)

Owners: Put the "Golden Handcuffs" on your Key Executives | Use for Retention or Recruiting

WHY USE AN EXECUTIVE BONUS PLAN?

How It Works?

Using executive bonuses to fund a tax-advantaged plan can be a smart way to provide additional benefits to executives while also gaining some tax advantages for the company.

Executive Bonus Plan (Section 162 Bonus Plan) is a simple way for businesses to provide additional compensation to key employees or executives. The business provides a bonus which the executive can use to pay the premiums on a life insurance policy. The premiums are deductible to the company as a business expense.

A VALUABLE INCENTIVE TO KEY EMPLOYEES

Unlock The Power of Your

Executive Bonus Plan

A mutually beneficial financial strategy:

Section 162 Executive Bonus Plans offer a valuable incentive to key employees by funding an IUL policy. An Indexed Universal Life (IUL) policy not only provides a death benefit, but also cash value growth linked to a stock market index, without direct market participation.

This allows beneficiaries to enjoy potential market-linked gains while being protected from downturns. Employers can deduct these premium payments as a business expense, and employees receive a valuable life insurance policy with tax-advantaged growth potential. The combination of Section 162 and IUL offers both companies and their key personnel a mutually beneficial financial strategy.

THE DISTINCTIVE ADVANTAGE

A Premier Financial

Strategy

Unlock The Power of...

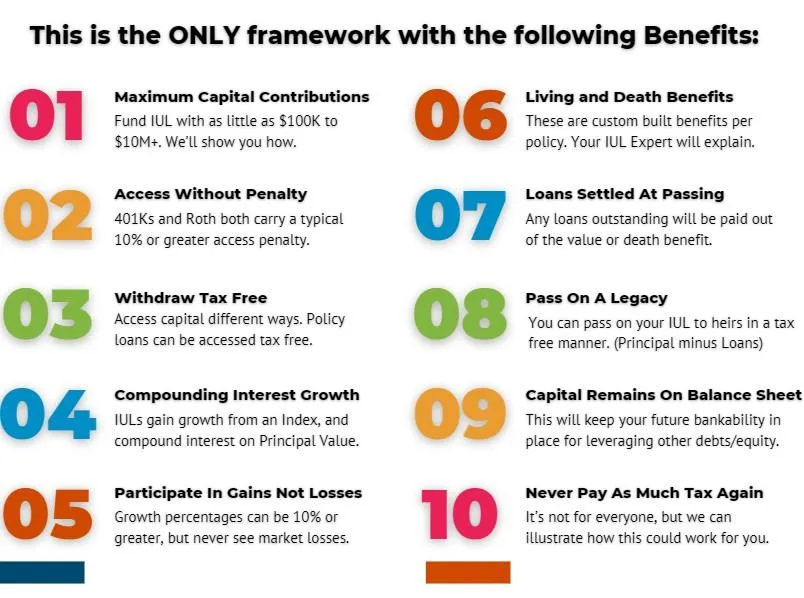

An Executive Bonus Split Dollar Plan with Indexed Universal Life (IUL) insurance.

This premier strategy fuses the tax-efficiency and flexibility of bonus arrangements with the growth potential of IUL, offering key employees a distinctive advantage.

It not only provides essential death benefit protection but also an opportunity for cash value accumulation linked to market performance. Dive into this dynamic combination to elevate your executive compensation packages, retain top talent, and optimize financial outcomes for both businesses and employees."

EXECUTIVE BONUS PLAN

Key Employee Benefits

Tax Advantages

Earnings grow tax-deferred within the policy. Additionally, funds can be withdrawn tax-free up to the amount of premiums paid, and loans can be taken against the cash value tax-free.

Supplemental Retirement Income

The cash value in the IUL can be used as a source of supplemental retirement income, which can be beneficial for executives.

Downside Protection

IULs typically have a floor, which means even if the market performs negatively, the cash value won't decrease due to market loss.

Flexible Premiums

Unlike whole life insurance, IULs often allow flexible premium payments.

Bonus Structure

Companies can structure the premium payments as bonuses, making them deductible as a business expense

Golden Handcuff

Offering an IUL as an executive bonus can be a retention tool, encouraging key executives to remain with the company

Death Benefit

In the event of the executive's death, the death benefit can be paid out to the beneficiaries tax-free

Dependents

If you have family or others who depend on your income, life insurance can provide financial support if you were to pass away.

Estate Planning

If you have a large estate, life insurance can provide liquidity for estate taxes.

Debts

If you have significant debts, life insurance can help cover them, ensuring they're not passed on to loved ones.

End-of-Life Expenses

Life insurance can cover funeral costs and other final expenses

Cost

Premiums can vary based on age, health, type and amount of coverage. It's generally cheaper when you're younger and healthier.

Additional Benefits

Policies offer riders, such as critical illness coverage or long-term care insurance.

Employer-Provided Insurance

Some jobs offer life insurance as a benefit. Consider if it's enough and if you'll keep that coverage if you change jobs.

Investment Component

Some jobs offer life insurance as a benefit. Consider if it's enough and if you'll keep that coverage if you change jobs.

EXECUTIVE BONUS PLAN

Employer Benefits

Financial Security

Provides financial protection against the unexpected loss of a key individual, helping the company stay afloat during a transition.

Debt Protection

The payout can be used to settle any outstanding debts, which might be challenging to service without the key individual's contribution.

Compensation for Losses

If a key individual contributes significantly to the company's revenue, their absence could lead to financial setbacks. A key person plan can compensate for this loss.

Business Continuity

The sudden loss of a key person can disrupt business operations. Plan funds can be utilized to find or train a replacement, ensuring smooth business continuity.

Credibility with Stakeholders

Having a key person plan can reassure stakeholders, creditors, and investors that the business is prepared for unforeseen events and is committed to long-term viability.

Costs of Recruitment & Training

Hiring and training a replacement can be expensive. The plan can cover these costs, ensuring a smoother transition.

Safety Net

In essence, a key person plan acts as a safety net, allowing a business to mitigate the risks associated with the loss of a critical team member.

MEET YOUR 'GROWTH PARTNERS" & EXPERTS

Get Started with the Executive Bonus Plan

COPYRIGHT © 2024 - THE BENEFIT STORE DBA EMPLOYER COST SAVINGS GROUP LLC - ALL RIGHTS RESERVED

NPN #19677564 | CA #6004127 | NV #3593959