Attn: Business Brokers

We're Expanding Our Partnerships

Want solutions to instantly increase your client's EBITDA by 4X - 6X in preparation for their exit, while significantly increasing your future commissions?

(Sign up as a Referral Partner & receive all 3 Action Rewards)

✅ Want your referral base to grow exponentially this year, and beyond?

✅ What an extremely "unique value proposition" when it comes to creating a higher valuation for your client & getting paid?

✅ Although, we offer M&A services, your clients will NEVER be pitched on that service. We're an entrusted partner.

HOW IS THIS POSSIBLE?

✅ Split Dollar & Section 162 Executive Bonus Plans: Help your clients significantly offset their income tax liabilities, take out capital from their companies without paying a Distribution/Dividend Tax. They're also able to access excess capital on the balance sheet without paying a Retained Earnings Tax, while still showing the capital on the balance sheet. Even further, we'll introduce them to a structure that can help them recruit and retain top talent/key executives/employees.

✅ Workers Comp Insurance: In working with our SIG + Installation of our 360 Preventative Health Plan and Workers Comp Risk Mitigation Platform, employers can get up to 30% off their Premium. (cashflow re-capture)

More info: https://www.employercostsavings.com/workers-comp-insurance

✅ 360 Preventative Health Plan + Workers Comp Mitigation Platform: Implementation of the Nation's Leading "Workers Comp Risk Mitigation Platform" powered by a Section 125 Preventative Health POP Plan (Premium Only Plan) which provides up to a 30% reduction on their workers comp premiums and claims. (cashflow re-capture)

$0 additional net costs to employers or employees

** This service is provided via Group Benefit Brokers only. We will align you with one of our approved Brokers.

✅ Get more information: https://thebenefitstore.com

✅ Email us if interested: [email protected]

✅ Employer Group 401K Conversions: Many employers are at significant risk to lawsuits from disgruntled employees that may have lost money in their 401Ks, but also large fines from the DOL.

When you help an employer reduce these risks, this can add significant value during a sale.

✅ Impact Group Health Share Plans: (For employer groups with 49 or less employees) This is an alternative to an employer groups comprehensive medical plan. These health sharing plans can provide savings of 30% - 50% off their existing Group Healthcare Plan, and a great option for non-insured employees.

Our services can help you create an additional "value proposition" to your existing services, while providing an additional income stream.

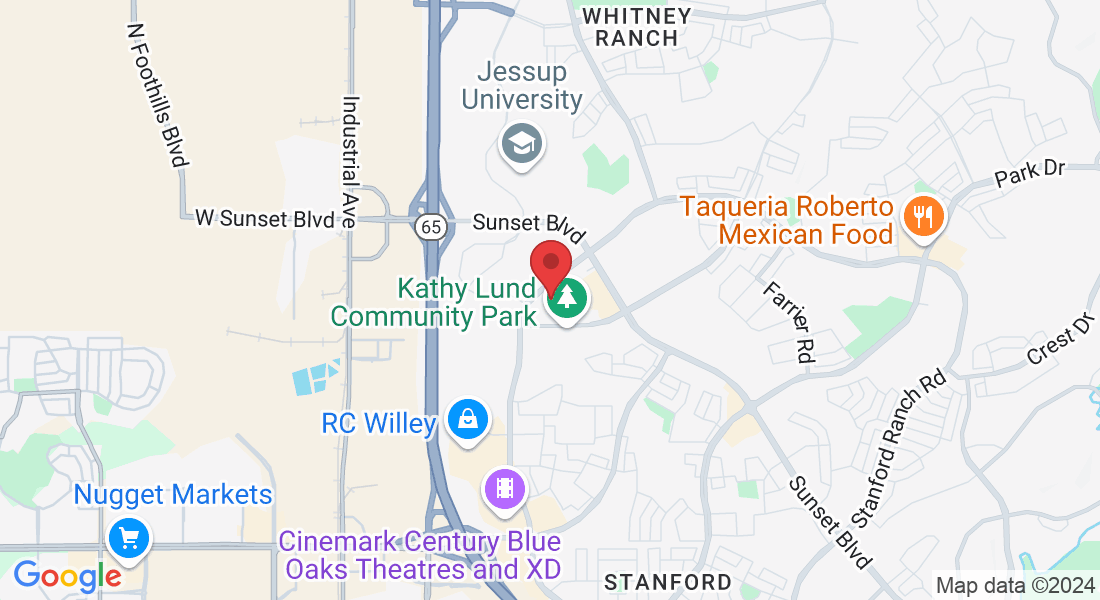

Please preview below, and click any of the "Get Started" buttons. We look forward to creating a strategic partnership with you.

INCREASE YOUR VALUE PROPOSITION

360 Preventative Health Plan + Workers Comp Risk Mitigation Platform

Ideal Clients: 50+ Full Time W2 Employees | All Risk Classes

An employer's three biggest expenses following Payroll are Workers Comp Premiums, Taxable Income Liabilities, and Group Healthcare. Workers Comp Premiums are expected to increase 4.9%+ in 2024 atop the 11% in 2022. Group Health Insurance is expected to rise another 6.5%+ in 2024, and Taxes will always rise. Our partners are in a position to offer businesses essential savings that create immediate "Cash Flow" re-capture. Our models allow our partners to get paid on a "Per Employee Per Month" residual basis.

✅ Our Workers Comp Risk Mitigation Platform is at "$0 Additional Net Costs" to the employer, or employee. This is powered by a Section 125 POP Plan.

✅ Executive Bonus Plans are highly desired because they're multi-purpose. They can be structured to significantly reduce taxable income liabilities for business owners, as well as be used to for an Executive or Key Employee Benefit Packages. We speak with clients about rolling their newfound savings into a split dollar executive bonus plan.

In Partnership with Alloy

Split Dollar & Section 162 Executive Bonus Plans

Ideal Clients: Business Owners + C-Suite Executives

Executive Bonus Plans are highly desired because they're multi-purpose. They can be structured to significantly reduce overall taxable income liabilities for business owners.

✅ Access balance sheet capital without paying a distribution, or dividend tax.

✅ Avoid holding capital and the retained earnings tax.

✅ Executive Bonus Plans can also strategically be used for Recruiting or Retaining top C-Suite talent. This is also known as the "Golden Handcuffs".

To Receive Compensation:

Executive Bonus Plans - Must Be Life Insurance Licensed

Impact Health Share for Groups

Ideal Clients: < 49 Employees

For the populace that's been priced out of healthcare, or the Employer that wants to significantly reduce their group healthcare plan expenditures. Impact Health Sharing delivers a modern and affordable alternative to health insurance. In some ways, it functions the same as current health plans, but different in ways that matter.

To Receive Compensation:

No Life or Health Insurance Licensing Is Required

Impact Health Share For Groups

✅ Most members save abut $500 monthly. Plans start as low as $73 for individuals, and $378 for families.

✅ Great secondary coverage and prescription savings for seniors on Medicare.

✅ Dental and Vision coverage.

Non-Profit and 1M+ members Nationwide.

This is a "minimal upfront and monthly cost" opportunity for our Partners.

Compensation is paid "Per Employee, Per Month".

Click the link below, create your Free Account, and preview our backend portal.

401K Conversions For Employer Groups

If you're a business owner that has offered an Employer Sponsored ERISA 401K Plan, you'll want to pay close attention. Schedule your consultation with your Employer Group 401K conversion expert to discuss details.

To Receive Compensation:

No Life or Health Insurance Licensing Is Required

Here are the Pros:

✅ Relieves Business Owner(s) of Fiduciary Liabilities

✅ Relieves Business Owner(s) of ERISA Responsibilities & Liabilities

✅ Provides Employees with a 5% Contribution Bonus for 8 years

✅ Downside Protection on all Plans (F.I.A.)

✅ Uncapped Index Strategies Available

✅ No T.P.A. / Bookkeeping / Administrative Fees

✅ Small expense to the Business Owner

✅ Simple & Hassle Free

COPYRIGHT © 2024 - THE BENEFIT STORE DBA EMPLOYER COST SAVINGS GROUP LLC - ALL RIGHTS RESERVED

NPN #19677564 | CA #6004127 | NV #3593959

DISCLAIMER: The sales figures stated anywhere on this website or any of our funnels are individual sales figures and marketing results. Please understand that sales figures are not typical, and we are not implying that you will duplicate them. We have the benefit of doing financial, life and health insurance marketing for 5+ years, and have an established following as a result. The average person who simply purchases any “how-to” program, or joins a network marketing company, or participates in ANY business opportunity may not follow through on what they are being taught and because of that we cannot guarantee any specific result. We are using these references for example purposes only. Sales figures will vary and depend on many factors including but not limited to background, experience, and work ethic. All business entails risk as well as massive and consistent effort and action. If you’re not willing to accept that, this is not for you.

Hi! We use cookies, including third-party cookies, on this website to help operate our site and for analytics and advertising purposes.

For more on how we use cookies and your cookie choices, go here for our cookie policy!